Mastering volume analysis through stock trading courses is a powerful tool for traders aiming to accumulate wealth. By studying trade volumes, investors gain insights into market sentiment, identifying trends and potential entry/exit points. This nuanced understanding enables informed decisions, maximizing profits in volatile markets. Comprehensive stock trading courses teach traders to interpret volume patterns, unlocking opportunities for wealth creation by navigating market dynamics effectively.

In the dynamic realm of stock trading courses, understanding volume analysis is a game changer for navigating market sentiment. This powerful tool enables traders to decipher hidden patterns and signals within trading volumes, crucial for timely entry and exit strategies. By exploring The Role of Volume in shaping wealth accumulation, this article unveils practical insights from basic interpretation to advanced techniques, empowering traders to harness the synergy of volume and price for optimal gains.

- Understanding Volume Analysis: Unlocking Market Sentiment in Stock Trading Courses

- The Role of Volume in Entry-Exit Timing Strategies

- Interpreting Volume Data: Patterns and Signals for Wealth Accumulation

- Practical Application: Implementing Volume Analysis in Your Trading Journey

- Advanced Techniques: Enhancing Wealth Within Through Volume-Price Synergy

Understanding Volume Analysis: Unlocking Market Sentiment in Stock Trading Courses

Volume analysis is a powerful tool that goes beyond price charts in stock trading courses. By examining the volume of trades, traders can gain valuable insights into market sentiment and potential entry-exit points. This technique is particularly crucial for those seeking wealth within volatile markets. Understanding that price movements are not solely driven by supply and demand, but also by the enthusiasm or fear of traders, can provide a significant edge.

In stock trading courses, learning to interpret volume patterns teaches traders how to identify accumulations and distributions of shares. For instance, a sharp increase in volume during a price rise suggests growing interest from buyers, potentially signaling an entry point. Conversely, declining volume amidst a price decline may indicate that sellers are fatigue or buyers are lacking enthusiasm, hinting at a possible exit strategy. This nuanced understanding of market behavior empowers traders to make more informed decisions, ultimately aiming for wealth within the stock market’s complexities.

The Role of Volume in Entry-Exit Timing Strategies

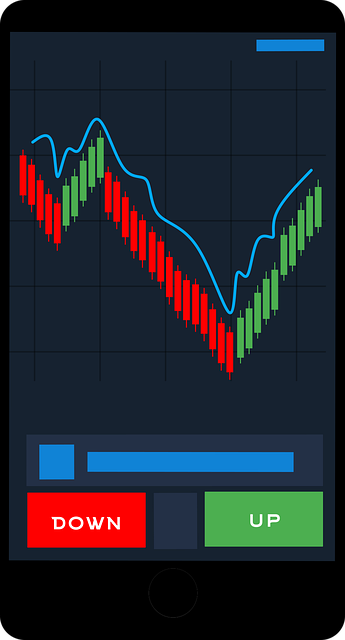

In the dynamic world of stock trading courses, understanding volume analysis is a game-changer for aspiring traders aiming to unlock wealth within the markets. Volume, or the number of shares traded over a specific period, serves as a powerful indicator of market sentiment and potential entry-exit points. By deciphering volume patterns, traders can make more informed decisions about when to step into a trade and when to exit, thereby maximizing profits. This strategy is particularly useful in identifying trends, as high volume often confirms the strength and direction of a particular movement.

Traders utilizing volume analysis can detect strong buying or selling pressure by observing sharp increases or decreases in trading volume. For instance, if a stock experiences a significant surge in volume while price rises, it suggests robust buyer interest and could signal an opportune entry point. Conversely, a drop in volume during an upward price move might indicate weakening momentum, prompting traders to consider exit strategies. Such insights are invaluable for navigating the markets effectively and can contribute to achieving consistent wealth accumulation over time.

Interpreting Volume Data: Patterns and Signals for Wealth Accumulation

In the world of stock trading courses, understanding volume analysis is a game-changer for those seeking to accumulate wealth within the market. Volume data provides insights into the number of shares traded over a specific period, revealing hidden patterns and signals that can inform entry and exit strategies. By deciphering these volumes, traders can uncover robust trends, identify pivotal points, and time their trades accordingly.

The interpretation of volume data involves recognizing key patterns such as cumulative volume charts, which show the accumulation or distribution of shares over time. An upward trend in volume during a price increase suggests growing investor interest and potential for continued gains, while a decrease in volume during an upward price move may indicate weakening momentum. These signals are crucial for making informed decisions, ensuring traders not only enter trades at optimal moments but also exit them when the market dynamics shift, thus maximizing their chances of wealth accumulation.

Practical Application: Implementing Volume Analysis in Your Trading Journey

Incorporating volume analysis into your trading strategy can significantly enhance your entry and exit points for maximum gains. When navigating the complex landscape of stock trading courses, understanding market sentiment through volume patterns emerges as a powerful tool. This practice involves examining the relationship between stock price movements and trading volumes to identify trends, confirm signals, and gauge market momentum. By doing so, traders can make more informed decisions about when to enter or exit positions, aiming for that elusive wealth within the market.

For instance, an increase in volume during a price ascent suggests growing enthusiasm among investors, potentially indicating a strong upward trend. Conversely, declining volume during a price rise may signal weakening momentum, suggesting it’s time to consider an exit strategy. Practical application involves learning to interpret these signals, combining them with other technical indicators for a comprehensive trading perspective. Many stock trading courses prioritize this skill, equipping traders with the knowledge to navigate markets efficiently and potentially unlock greater wealth within their investments.

Advanced Techniques: Enhancing Wealth Within Through Volume-Price Synergy

In the realm of advanced stock trading techniques, understanding volume analysis is a game-changer for aspiring traders aiming to enhance their wealth. Volume-price synergy offers valuable insights into market sentiment and can be a powerful tool when mastered through comprehensive stock trading courses. By deciphering the relationship between share volume and price movements, traders can uncover hidden opportunities for entry and exit points, potentially boosting their profits.

This strategy involves recognizing that significant changes in stock prices often correlate with substantial trading volumes. For instance, a sharp rise in volume during an upward price move suggests growing investor enthusiasm, signaling a potential entry point for eager investors. Conversely, a sudden drop in volume during a downtrend might indicate weakening momentum, providing a strategic exit signal. Proficient traders learn to interpret these patterns, combining volume analysis with technical indicators for more accurate trading decisions, ultimately fostering wealth within the market.

Volume analysis is a powerful tool for traders aiming to enhance their entry-exit timing and ultimately accumulate wealth within the market. By understanding market sentiment through volume patterns and utilizing these insights in stock trading courses, investors can make more informed decisions. This strategic approach, combined with advanced techniques, allows traders to navigate the markets effectively and potentially increase their chances of success on their journey towards financial goals.