Involved in stock trading? Understanding bull and bear markets is crucial. Bull markets offer growth, while bears present challenges. Stock trading courses equip investors with skills for both scenarios: long-term investing, portfolio diversification, and risk management. Diversification and strategic moves protect wealth within reach, enabling individuals to navigate market fluctuations and achieve long-term financial success.

In volatile markets, navigating between bear and bull trends is essential for investors. This guide delves into the intricacies of understanding these market conditions, offering a beginner’s perspective on identifying and preparing for both. From recognizing patterns to mastering stock trading courses, you’ll gain insights into thriving in bullish environments and preserving wealth during bears. Discover effective strategies, including diversification and risk management techniques, to optimize your investment journey and achieve wealth within reach.

- Understanding Bear and Bull Markets: A Beginner's Guide

- Stock Trading Courses: Equip Yourself for All Market Conditions

- Strategies to Thrive in a Bull Market: Building Wealth

- Navigating the Challenges of a Bear Market: Preserving Wealth

- Wealth Within Reach: Diversification and Risk Management Techniques

Understanding Bear and Bull Markets: A Beginner's Guide

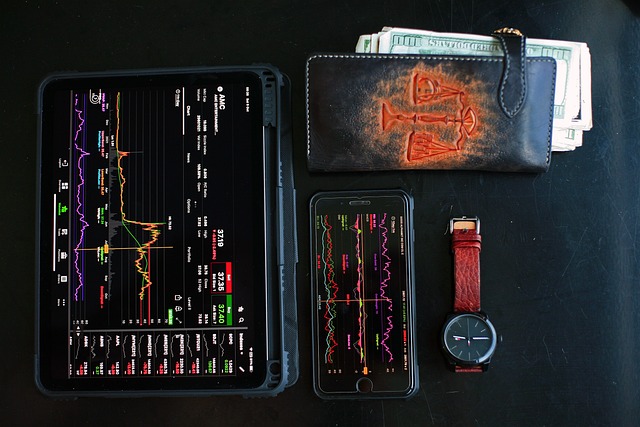

In the world of stock trading, navigating bear and bull markets is an art that every investor should master, especially those looking to build wealth within the financial markets. A ‘bull market’ refers to a period of rising prices where investors are optimistic about the future, while a ‘bear market’ is characterized by falling prices and a more pessimistic outlook. Understanding these dynamics is crucial for anyone enrolled in stock trading courses aiming to maximize their potential returns.

Beginners should grasp that these market conditions can significantly impact investment strategies. During a bull market, stocks tend to soar, presenting opportunities for substantial gains. Conversely, bear markets offer challenges, but also potentially lucrative long-term investments when investors adopt the right mindset and approach. By recognizing these cycles, traders can make informed decisions, adapting their portfolios accordingly to weather any storm and capitalize on the next upswing, ultimately fostering wealth within the market’s ebb and flow.

Stock Trading Courses: Equip Yourself for All Market Conditions

In today’s volatile market landscape, navigating bear and bull trends effectively is a skill every aspiring investor should possess. Stock trading courses offer an invaluable resource for beginners and seasoned traders alike to equip themselves with the knowledge and strategies needed for all market conditions. By enrolling in these courses, you gain access to a wealth of information tailored to help you understand complex market dynamics.

Through interactive modules and practical exercises, stock trading courses empower individuals to make informed decisions, regardless of whether the market is soaring high or sinking low. You’ll learn about various investment strategies, risk management techniques, and market analysis tools that foster a deeper understanding of wealth creation within these dynamic environments. By mastering these skills, you’ll be better prepared to adapt and thrive in any market condition, ultimately enhancing your long-term success as an investor.

Strategies to Thrive in a Bull Market: Building Wealth

In a bull market, characterized by rising stock prices and optimistic investor sentiment, it’s a perfect time to build wealth through strategic stock trading. Those who have enrolled in comprehensive stock trading courses often find themselves at an advantage as they employ techniques such as long-term investing, diversifying their portfolio, and capitalizing on growth stocks. By identifying high-potential companies early on and holding onto these investments for an extended period, investors can ride the wave of positive market momentum to achieve significant gains.

Wealth within reaches in a bull market when investors take calculated risks, stay informed about market trends, and avoid impulsive decisions. Regularly reviewing and rebalancing your portfolio ensures that you maintain the desired asset allocation. This disciplined approach allows for capturing the best opportunities while managing risk effectively, ultimately contributing to substantial financial growth over time.

Navigating the Challenges of a Bear Market: Preserving Wealth

Navigating a bear market requires a strategic approach to preserve and protect your wealth. Bear markets are characterized by declining asset prices and a general sense of pessimism among investors, which can make it challenging to maintain financial stability. However, with the right knowledge and strategies, investors can navigate these turbulent times successfully. One key aspect is diversifying your portfolio across various asset classes, sectors, and industries. By spreading your investments, you reduce the impact of any single asset’s decline. Additionally, rebalancing your portfolio regularly can help maintain your risk exposure at a desired level, ensuring that your wealth is not disproportionately affected by market downturns.

Enrolling in stock trading courses can equip investors with valuable insights into navigating bear markets effectively. These courses often teach fundamental analysis techniques to identify undervalued stocks and strategies for long-term investment. By learning how to assess companies’ fundamentals, investors can make informed decisions and potentially find opportunities within the market. Building a robust understanding of market dynamics enables investors to stay calm during volatile periods, making rational choices to preserve and even grow their wealth.

Wealth Within Reach: Diversification and Risk Management Techniques

In today’s dynamic financial landscape, navigating both bear and bull market conditions requires a strategic approach. One of the most effective tools at your disposal is diversification. By spreading your investments across various asset classes, industries, and sectors, you can mitigate risks associated with any single investment. This strategy ensures that even if one area underperforms, others may perform well, maintaining stability in your portfolio.

Furthermore, integrating stock trading courses into your educational arsenal can equip you with the knowledge to make informed decisions. These courses delve into various risk management techniques, such as setting stop-loss orders and establishing a robust risk-to-reward ratio. By understanding these concepts, you can better protect your wealth and maximize returns in any market environment. Remember, when wealth is within reach, a well-diversified portfolio and solid risk management practices are key to achieving long-term financial success.

Whether navigating a bustling bull market or a more challenging bear market, understanding these cycles is key to successful investing. By equipping yourself with knowledge through stock trading courses and implementing strategies like diversification, you can build and preserve wealth in any condition. Remember, staying informed and adapting your approach allows you to seize opportunities and mitigate risks, ultimately keeping your financial goals within reach.