Candlestick charts, a key component of stock trading courses, provide visual insights into price movements by showing open, high, low, and close prices over specific intervals. Recognizing patterns like Doji, Engulfing, and Hammer helps beginners interpret price action, predict trends, and make informed decisions in volatile markets. Combining candlestick analysis with technical indicators and fundamental research enhances stock trading courses success, while common mistakes include relying solely on historical data or focusing too much on short-term fluctuations.

Mastering candlestick patterns and chart analysis is a crucial step for anyone looking to enhance their stock trading skills. This comprehensive guide delves into the basics of understanding candlestick charts, identifying key price patterns, and utilizing technical analysis tools. Learn how to avoid common mistakes and refine your trading strategies through effective pattern recognition. Whether you’re a beginner or seasoned trader, these essential insights from top stock trading courses will empower you to navigate markets with greater confidence and precision.

- Understanding Candlestick Charts: Basics Explained

- Key Patterns to Identify in Stock Prices

- Technical Analysis: Tools for Chart Interpretation

- Common Mistakes to Avoid During Chart Analysis

- Enhancing Trading Strategies with Pattern Recognition

Understanding Candlestick Charts: Basics Explained

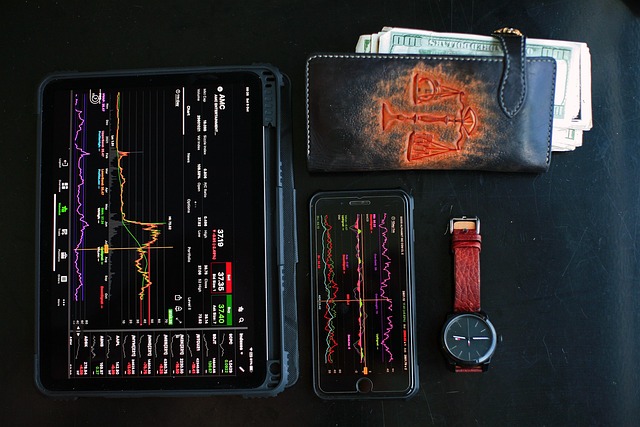

Candlestick charts are a powerful tool for traders, providing a visual representation of price movements in the financial markets. Each candlestick represents a specific time period, typically an hour, day, or week, and displays key information in a compact format. The chart consists of various elements: the open, high, low, and close prices during that interval. This simple yet effective method allows traders to quickly grasp market dynamics, identify trends, and make informed decisions.

Understanding candlestick patterns is an essential aspect of stock trading courses. By studying these charts, traders can interpret price action, anticipate potential reversals or breakouts, and make strategic moves. Basic candlestick patterns include Doji, Engulfing, and Hammer formations, each offering unique insights into market sentiment. This basic knowledge equips beginners with valuable tools to analyze charts, enhancing their overall trading experience and decision-making process.

Key Patterns to Identify in Stock Prices

In the realm of stock trading courses, understanding candlestick patterns is a crucial skill for traders of all levels. Candlestick charts provide invaluable insights into price movements by presenting data in a visually rich format. Key patterns to identify include Doji, Harami, and Engulfing patterns, each offering unique clues about market sentiment.

Doji patterns indicate indecision or a balanced market, where the opening and closing prices are close. Harami patterns suggest a potential trend reversal after an initial spike. Engulfing patterns, on the other hand, signal a strong trend change, with the current day’s candle swallowing the previous one. Proficiency in these patterns enables traders to make more informed decisions, enhancing their ability to navigate market volatility and capitalize on emerging trends.

Technical Analysis: Tools for Chart Interpretation

Technical analysis is a crucial skill for traders, especially those looking to master stock trading courses. It involves using historical price and volume data to identify trends and potential future movements in the market. By studying candlestick patterns, traders can gain valuable insights into market behavior and make informed decisions. Candlestick charts are an essential tool here, visually representing the opening, closing, high, and low prices of a security during a specific time frame. Each candlestick provides a snapshot of market sentiment at that particular moment.

Traders often rely on various technical indicators to enhance their chart analysis. These tools include moving averages, relative strength index (RSI), and Bollinger bands, which help identify trends, overbought or oversold conditions, and potential support or resistance levels. Integrating these analytical techniques with candlestick patterns allows traders to make more accurate predictions and execute successful trades in the dynamic world of stock trading courses.

Common Mistakes to Avoid During Chart Analysis

When studying candlestick patterns and chart analysis, beginners often fall into several common traps. One major mistake is trying to predict the future based solely on historical data. While past performance can offer insights, markets are dynamic and influenced by a myriad of factors. Relying too heavily on chart patterns without considering broader market trends, news, and economic indicators can lead to inaccurate predictions.

Another frequent error is getting caught up in the noise of short-term fluctuations. Candlestick analysis is most effective when used to identify longer-term trends. Focus on the big picture rather than getting distracted by daily or hourly price movements. Skipping essential fundamental analysis in favor of solely technical charting can also prove detrimental. Successful stock trading courses emphasize the importance of understanding company performance, industry dynamics, and market sentiment alongside chart patterns.

Enhancing Trading Strategies with Pattern Recognition

Pattern recognition is a powerful tool for traders, enabling them to identify recurring candlestick patterns and make informed decisions. By studying these patterns, traders can enhance their stock trading strategies and gain an edge in the market. Candlestick analysis provides valuable insights into price movements, sentiment shifts, and potential reversals or breakouts.

Many successful trading strategies rely on pattern recognition as a core component. Stock trading courses often emphasize this skill, teaching students how to identify common candlestick patterns such as Dojis, Hammers, Engulfing Patterns, and Morning Stars. These patterns can signal strong market trends, offer entry and exit points for trades, or predict potential price reversals. With practice, traders become adept at interpreting these visual cues, leading to more effective decision-making in their stock investments.

Candlestick pattern recognition and chart analysis are essential skills for any aspiring trader. By understanding market psychology through candlestick charts, you gain a powerful tool to decipher price movements. This article has provided an overview of key patterns, technical analysis tools, and common mistakes to avoid. Now, with this knowledge in hand, it’s time to enhance your trading strategies by enrolling in comprehensive stock trading courses designed to deepen your chart interpretation skills. Remember, mastering candlestick patterns can be a game-changer in navigating the markets.